haven't filed taxes in 5 years canada

The penalty charge will not exceed 25 of your total taxes owed. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

How To File Taxes For Your Online Business 2022

If you and your spouse or.

. Hello all My wifes I-130 has been accepted and her interview. Generally the IRS is not. But if you filed your tax return 60 days after the due date or the.

The following are some of the prior year forms and schedules you may need to file your past due returns. Self-employed workers have until June 15 2018 to file their tax return. On 4202016 at 613 AM LondonWelsh said.

This penalty is usually 5 of the unpaid taxes. Courts may impose a 5-year jail term or fine of up to 200 of the evaded taxes amount. Then reach out to the CRA 1-888-863-8657 to find out what your options are.

To request past due return incomeinformation call the IRS at 866 681-4271. You dont have to file taxes if There are very few circumstances that excuse your obligation to file. You can make partial.

Havent Filed Taxes for 5 Years. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. In most cases the IRS is not going to pursue any criminal action when all that is needed is to file those prior year returns and pay any taxes owed.

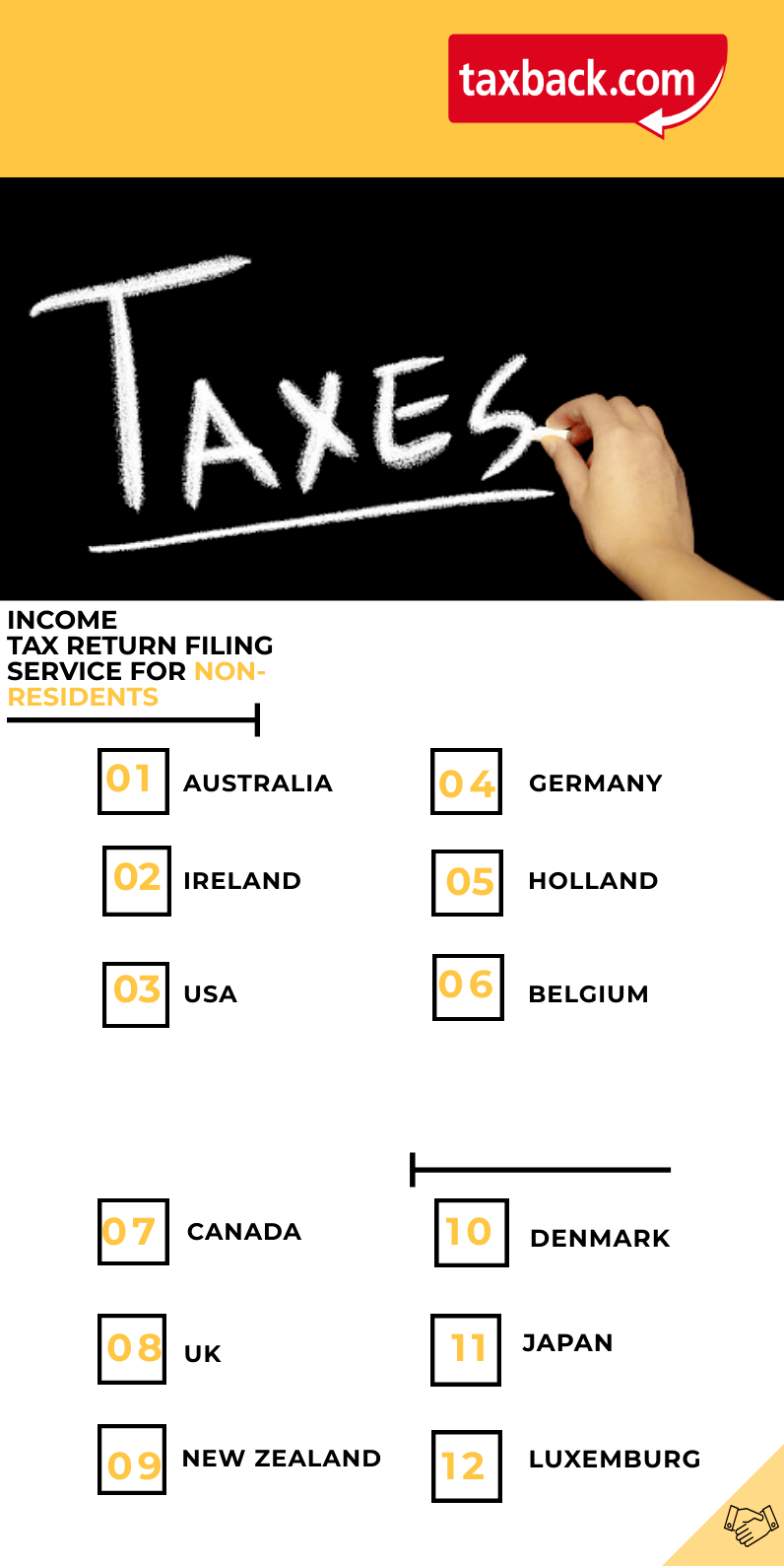

Most Canadian income tax and benefit returns must be filed no later than April 30 2018. What happens if you havent filed taxes for several years. We can help Call Toll-Free.

If you fail to file your taxes youll be assessed a failure to file penalty. Penalties include up to one year in prison for each. Interest Penalties The CRA will charge a late-filing penalty of 5 if you dont file your tax returns by April 30 plus an.

Failure to file and pay taxes is a serious issue with the IRS which can result in severe penalties said Jodi Cirignano. Im 28 years old and have been working full time since 2012. With years of experience in corporate and personal tax law Filing Taxes is your premier partner for all your tax needs in becoming up to date with your tax filing obligations.

Havent filed taxes in 10. On 4202016 at 520 AM Pte said. Without filing an income tax return the IRS may file an income tax return for you called a Substitute for Return without the benefit of any of the expenses.

What happens if you havent filed your taxes in 5 years Canada. Posted April 20 2016. Dont forget this is household income.

If you dont file a tax return you will be in violation of the law. If you make less than 40000 per year in the taxable income you are likely to be exempt from most taxes. Most taxpayers are required to file a tax return each year.

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. File your tax returns on time even if you cant afford to pay taxes you owe. Luckily filing and paying your taxes is still possible even if you havent filed in a while.

Here S What Happens If You Don T File Or Pay Your Taxes The Motley Fool

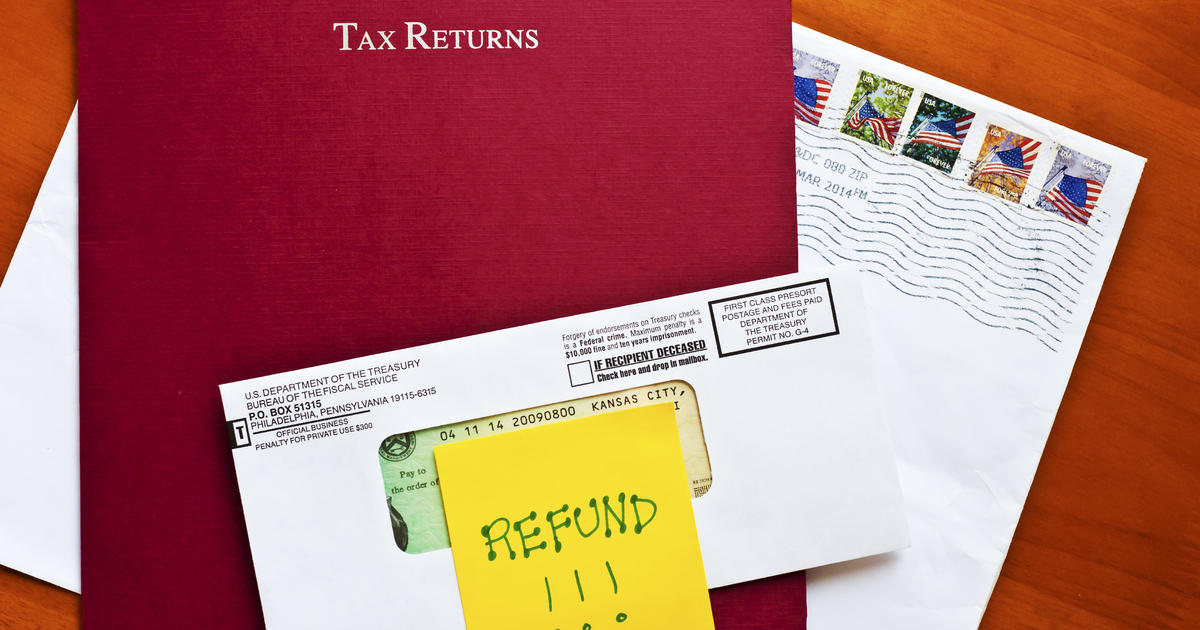

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

What To Do If You Ve Never Filed A Tax Return

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

The Fbar Who Should File And What Happens If You Don T

What Happens If I Haven T Filed Taxes In Years H R Block

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Can I Claim A College Student As My Dependent The Official Blog Of Taxslayer

What To Do If You Haven T Filed Taxes In Years Money We Have

What To Do If You Haven T Filed Your Taxes In A Few Years Or More

How To File A Late Tax Return In Canada

How To File Taxes For Your Online Business 2022

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

I Haven T Filed Taxes In 5 Years How Do I Start

Dealing With A U S Tax Refund Delay Here Are The Reasons For The Hold Up Freshbooks Blog

/cloudfront-us-east-1.images.arcpublishing.com/gray/UEKA5DRH4VEE7DDH7MZ67VRQIY.jpg)

Irs Backlogs Causing Massive Delays In Processing Returns

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Investment Executive